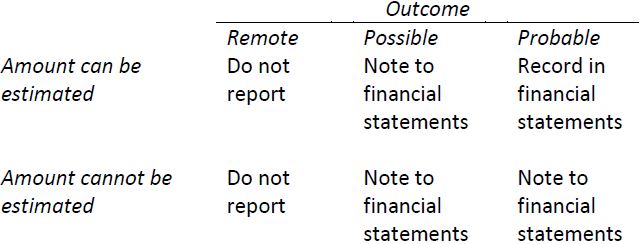

An estimated liability is recorded when the liability is probable and the amount can be reliably estimated. A contingent liability exists as a result of a past occurrence, but only if possible (not probable) or is probable but the amount of the liability is not known at the date the financial statements are issued. A contingent liability is just disclosed in a note to the financial statement. A liability with only a remote likelihood of success is neither recorded nor disclosed in a note. The following is a summary of the treatment of these types of liabilities:

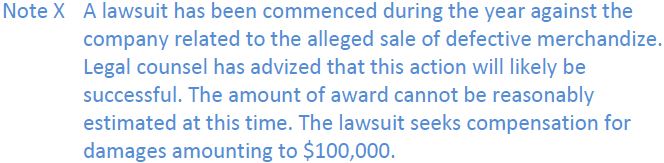

As an example, assume a lawsuit is commenced in 2015 against Jones Corp. claiming damages of $100,000. At December 31, 2015, lawyers for the company indicate that it is probable that the lawsuit will be successful but the damages cannot be reasonably estimated. In this case, a note to the financial statements might state:

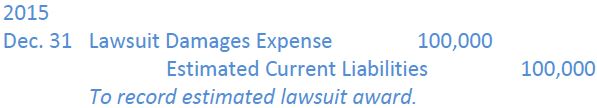

Assume now that it is probable that the lawsuit will be successful and that full damages will be awarded. The following entry would be recorded in the company’s records:

If this amount is relatively large, it would be reported in the Other Income (Expenses) section of the income statement.

- 4018 reads