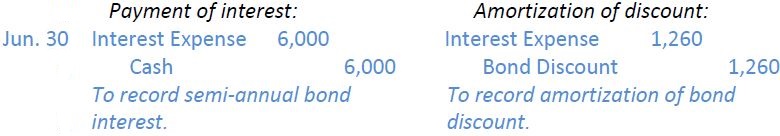

Journal entries to record interest payments and amortization are made each June 30 and December 31 in the same manner as for the straightline method (shown in section C). The actual interest paid to bondholders amounts to $6,000 each semi-annual period; the amount of discount amortization is taken directly from column D of the amortization table. These are the entries for period 1, January 1 to June 3.

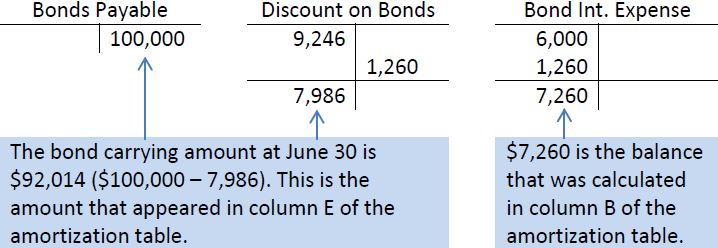

The entries for each remaining period are similar; only the amounts used for discount amortization differ, as shown in column D of the amortization table. After the posting of the June 30 entries, the following balances result:

- 2101 reads