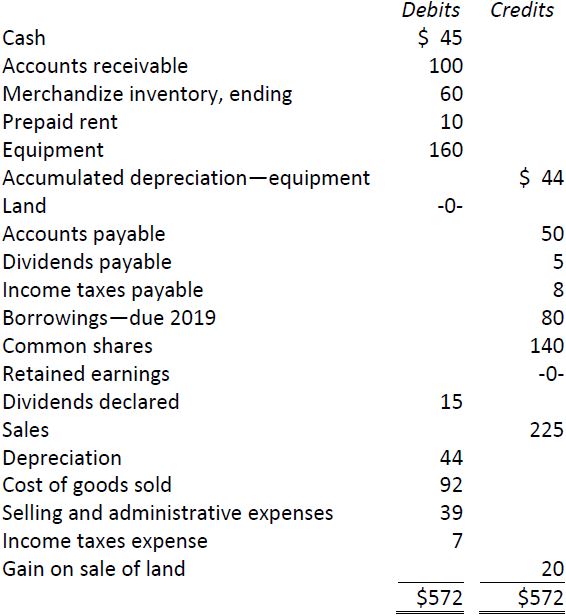

The following trial balance has been prepared from the ledger of Obelisk Corporation at December 31, 2017, following its first year of operations.

Additional information:

|

a. |

Obelisk assumed $100 of long-term debt during the year. |

|

b. |

Obelisk issued common shares for equipment, $40. Other equipment was purchased for $120 cash. No equipment was sold during the year. |

|

c. |

Land costing $30 was purchased, then sold during the year for $50. |

|

d. |

Some borrowings were repaid during the year for $20 cash. |

|

e. |

The company declared dividends of $15 during the year. |

Required:

- Calculate retained earnings at December 31, 2017.

- Prepare a statement of cash flows.

- Explain what the statement of cash flows tells you about Obelisk Corporation at December 31, 2017.

- 1860 reads