A warranty is a guarantee offered by the seller to replace or repair defective products. Warranties typically apply for a limited period of time. The seller does not know which product will require warranty work, when it might occur, or the amount. However, based on past experience, warranty expense can be estimated. Often this is based on a percentage of sales revenue. The adjustment is done at year –end. Doing this matches warranty expenses with revenue in the year of sale.

As an example, assume High Road Appliances Corp. estimated its warranty expense to be 5% of its sales revenue. Sales amounted to $500,000 for its first year ended December 31, 2015. To match the warranty expense to the period in which the revenue was realized, the following adjusting entry would be recorded at the year-end:

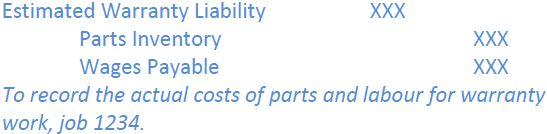

Prior to this year-end adjusting entry, parts and labour are used to perform warranty work during the year. The following type of entry is recorded many times as each piece of warranty work is completed:

These many small entries gradually increase the debit balance in the Estimated Warranty Liability account until the estimated liability account is adjusted as above to record the estimated expense.

Over time, the year-end balance in the Estimated Warranty Liability account should be stable if actual expenditures are equal to estimated expenditures. If the balance gradually increases or decreases, the estimate of warranty expense as a percentage of sales revenue needs to be reviewed and perhaps adjusted.

- 3940 reads