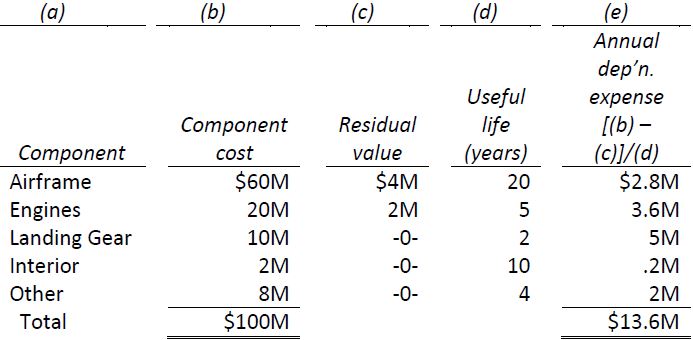

Each major component with a different estimated useful life from the rest of the asset must be recorded and depreciated separately. For instance, assume a commercial airliner is purchased for $100 million ($100M) on January 1, 2015 with the following components: airframe, engines, landing gear, interior, and other parts. The cost of each major component as well as its related accumulated depreciation should be recorded separately in the company’s records. Yearly depreciation expense is also calculated separately for each component as shown in the last column below (straight-line depreciation is assumed; ½ year rule is ignored), but these expenses are usually combined into one amount when reported on the income statement ($13.6M in this case).

Components that have the same estimated useful life, residual value, and depreciation method can be grouped together. In the above, example, engines are considered one major component, even though there may be several on the aircraft.

- 1980 reads