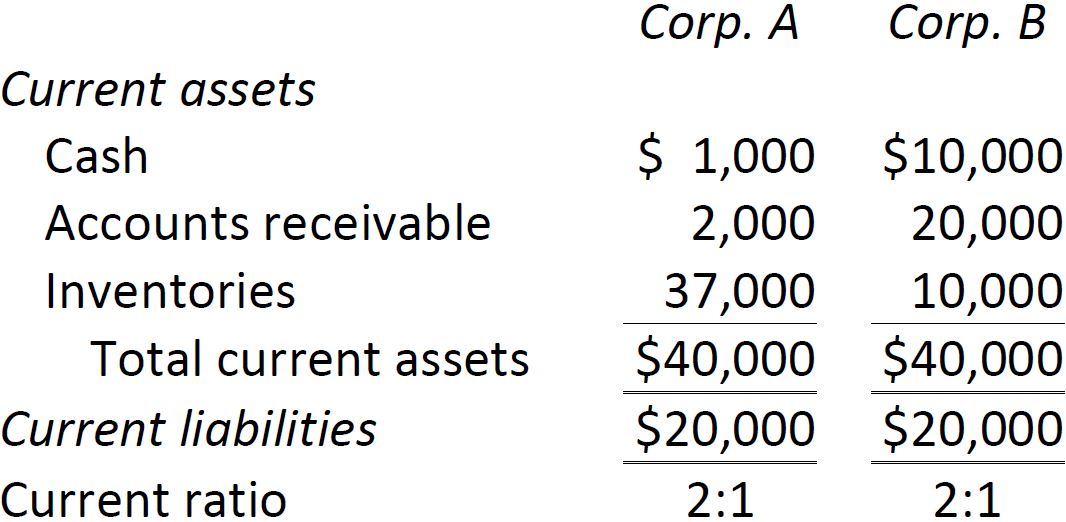

In the following example, both Corporation A and Corporation B have a 2:1 current ratio. Are the companies equally able to repay their short-term creditors?

The companies have the same dollar amounts of current assets and current liabilities. However, they have different short-term debt paying abilities because Corporation B has more liquid current assets than does Corporation A. Corporation B has less inventory ($10,000 vs. $37,000) and more in cash and accounts receivable. If Corporation A needed more cash to pay short-term creditors quickly, it would have to sell inventory, likely at a lower-than-normal gross profit. So, Corporation B is in a better position to repay short-term creditors.

Since the current ratio doesn’t consider the components of current assets, it is only a rough indicator of a company’s ability to pay its debts as they become due. This weakness of the current ratio is partly remedied by the acid-test ratio discussed below.

- 3247 reads