Costs to transport goods from the supplier to the seller must also be considered when recording the cost of merchandize inventory. The shipping terms on the invoice identify the point at which ownership of the inventory transfers from the supplier to the purchaser. When the terms are FOB shipping point, ownership transfers at the ‘shipping point’ so the purchaser is responsible for transportation costs. FOBdestination indicates that ownership transfers at the ‘destination point’ so the seller is responsible for transportation costs. FOB is the abbreviation for “free on board.”

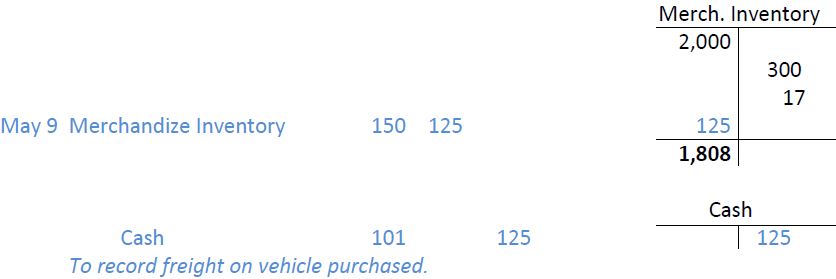

Assume that Excel’s supplier sells with terms of FOB shipping point indicating that transportation costs are Excel’s responsibility. If the cost of shipping is $125 and this amount was paid in cash to the truck driver at time of delivery on May 9, the entry would be:

The cost of the vehicle in the Excel Merchandize Inventory account is now $1,808. It is important to note that Excel’s transportation costs to deliver goods to customers are recorded as delivery expenses that do not affect the Merchandize Inventory account.

The next section describes how the sale of merchandize is recorded as well as the related costs of items sold.

- 2126 reads