Four machines were acquired by Gold Star Co. Ltd. during 2016 and 2017. Machine A was placed in use at the end of August 2016. Its cost was $26,400, the estimated useful life eight years, and the residual value $2,400. Depreciation was to be calculated on the straight-line basis. The company year-end is December 31. Machine A was valued at $12,000 by management on December 31, 2018 prior to calculation and recording of depreciation expense. Estimated disposal costs were $1,000. Residual value was zero. It was sold on March 31, 2019 for $10,000.

Machine B was purchased on October 1, 2016. The cost was $23,600, with a five-year life expectancy and a residual value of $3,600. Depreciation was to be calculated on a units-of-production basis. Estimated production over the five years is 50,000 units. In 2016, 3,000 units were produced, 11,500 in 2017 and 12,000 during 2018. Machines C and D were purchased on April 15, 2017 and were in production by September 1 of that year.

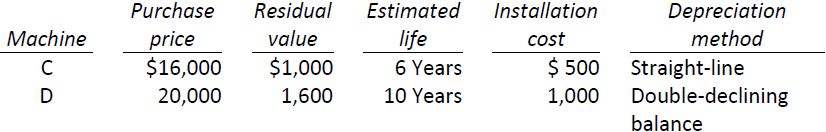

The following additional information about machines C and D:

The company uses the ½ year rule to calculate depreciation expense in the year of acquisition and disposal as applicable. Assume installation costs are material and were paid on the date the machines were placed in service.

Required:

- For each of the four machines, calculate depreciation expense for 2016 and 2017.

- Prepare the 2018 and 2019 journal entries for machine A.

- 1821 reads