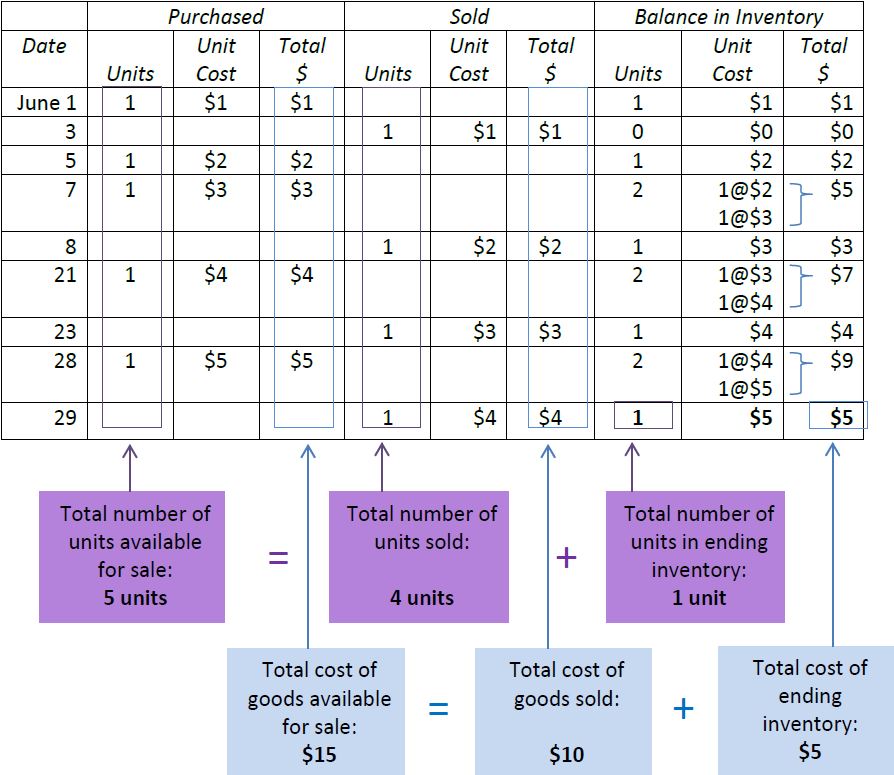

Using the same information, we now apply the FIFO cost flow assumption as shown in Figure 6.8.

When calculating the cost of the units sold in FIFO, the oldest unit in inventory will always be the first unit removed. For example, in Figure 6.8, on June 8, one unit is sold when the previous balance in inventory consisted of 2 units: 1 unit purchased on June 5 that cost $2 and 1 unit purchased on June 7 that cost $3. Because the unit costing $2 was in inventory first (before the June 8 unit costing $3), the cost assigned to the unit sold on June 8 is $2. Under FIFO, the first units into inventory are assumed to be the first units removed from inventory when calculating cost of goods sold. Therefore, under FIFO, ending inventory will always be the most recent units purchased. In Figure 6.8, there is one unit in ending inventory and it is assigned the $5 cost of the most recent purchase which was made on June 28.

- 5257 reads