Assume that the Sherbrooke Corporation declares a 10% share dividend to common shareholders. The dividend is declared on July 15, 2016 payable to shareholders of record on July 31, 2016. The share dividends were issued on August 5, 2016. At the time of the dividend declaration, the shareholders’ equity of the corporation consisted of the following:

Assume that at the date of dividend declaration, the common shares of the corporation were trading on the stock exchange at $4.

In this case, the share dividend is expressed as a percentage of the outstanding common shares. The dividend amounts to 500 shares (5,000 outstanding shares x 10%). This means that an individual investor owning 1,000 shares receives 100 new shares when the dividend is issued.

The market price of the shares is used to record a share dividend. This market price is usually the closing market price per share on the day preceding the declaration of the dividend. Since the shares are recorded at market value, the amount transferred from retained earnings to common shares is $2,000 (500 shares x $4 market value).

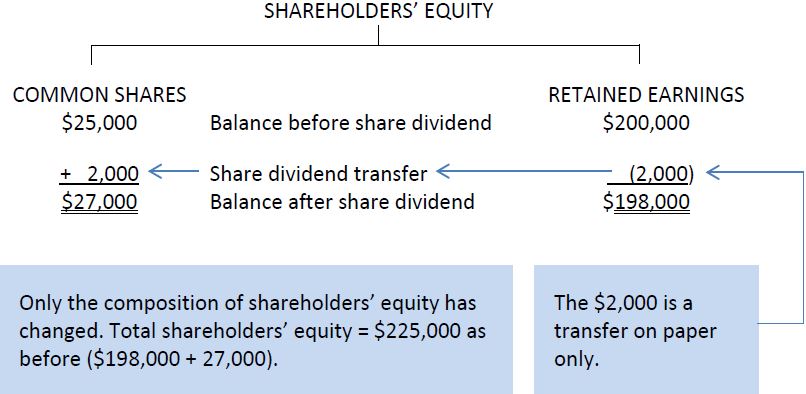

The $2,000 transfer to common shares means that this amount becomes a part of stated capital and the assets represented by the $2,000 are no longer available for the payment of future cash dividends. After the transfer has been recorded, shareholders’ equity appears as shown in Figure 11.5 below.

This transfer reduces retained earnings and increases common shares by the same $2,000 amount. Total shareholders’ equity remains unchanged, however. This is different from the distribution of a cash dividend, which reduces both retained earnings and cash and results in a lower amount of total shareholders’ equity.

Two journal entries at different dates are required to record the share dividend. The original dividend declaration would be recorded as follows:

The effect of this entry is to transfer $2,000 from retained earnings to share capital. No assets are paid by the corporation when the additional shares are issued as a shares dividend, and therefore thetotal shareholders’ equity remains unchanged at $225,000.

As with cash dividends, there is no effect on the accounting records on July 31 (individual shareholders of record are determined at that date).

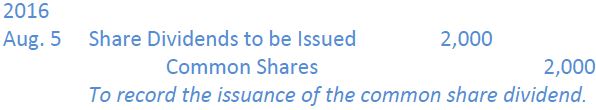

When the shares dividend is actually issued, the following entry would be made:

At the December 31 year-end of the corporation, the Share Dividend Declared account would be closed to the Retained Earnings account in the same way a Cash Dividend account is closed. The closing entry for a shares dividend would be:

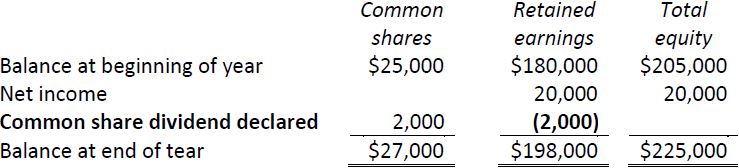

Assume that the retained earnings of $200,000 include $20,000 of net income earned in the 2016 year. The statement of changes in equity at December 31, 2016 would show (bolded for illustrative purposes):

- 6018 reads