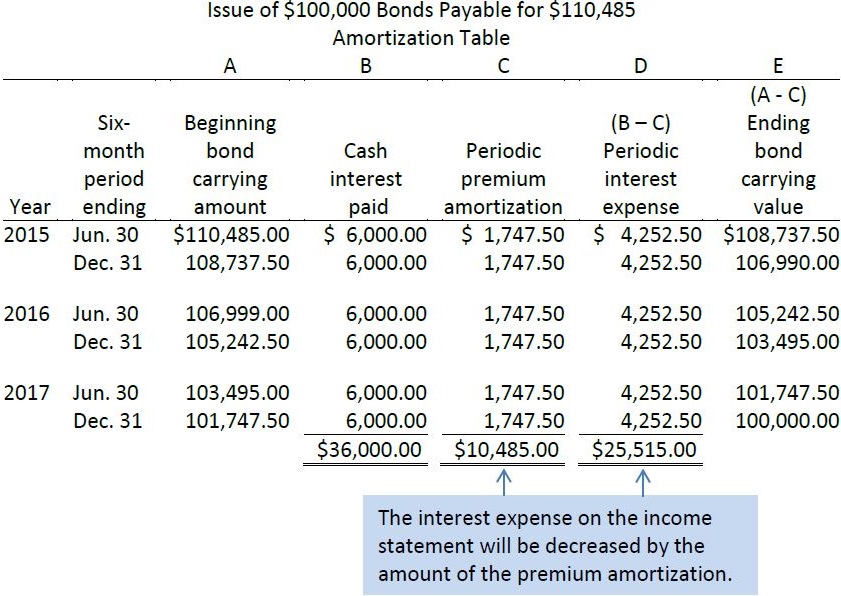

The effect of amortizing a premium is to reduce interest expense (note the credit to interest expense in the middle journal entry above). This is appropriate, because the market rate of interest was lower than the face value of the bonds actually issued in scenario 2 above (8% vs. 12%).

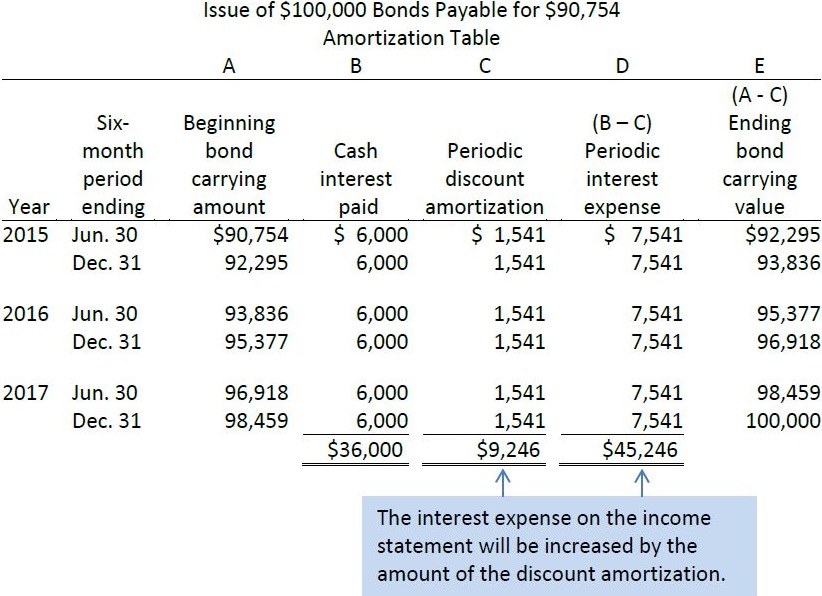

Amortizing a discount increases interest expense (note the debit to interest expense in the right-hand entry above). This is also appropriate, because in scenario 3 the market rate of interest was higher than the face value of the bonds (16% vs. 12%).

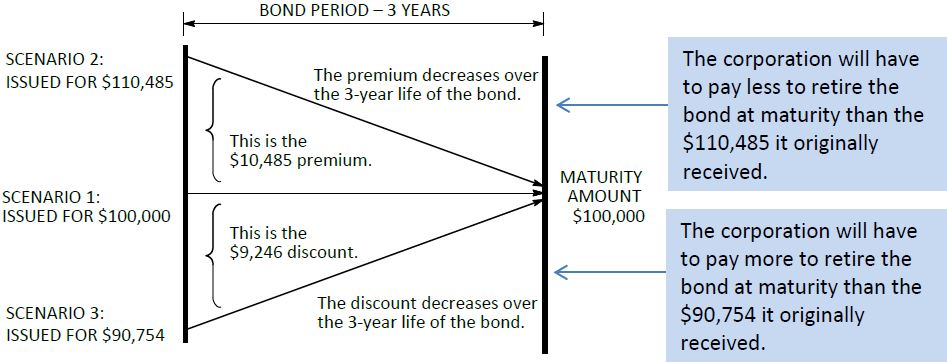

The effect of amortizing a premium or discount is to gradually change the carrying amount of the bonds to the retirement (face) value of the bonds. At retirement, carrying amount is equal to face value under each scenario, as shown in Figure 10.2 below.

The combined effect on interest expense and carrying amount of issuing the bonds at a premium and amortizing this premium over the life of the bonds is shown in Figure 10.3 below:

The similar combined effect of a discount is shown in Figure 10.4:

In the case of bonds issued at a discount, the interest rate consists of the 12% bond rate plus the amortized bond discount. The expense reported on the income statement is higher than the cash interest paid. Thus, whenever a corporation sells a bond for less than its face value, its total cost of borrowing is increased because of discount amortization.

- 2011 reads