As noted above, a loan is another form of long-term debt that can be used by a corporation to finance its operations.

Assume BDCC obtained a $100,000, 10% loan on January 1, 2015 from First Bank to acquire a piece of production equipment. When the loan proceeds are deposited into the bank account of BDCC, the company would make the following journal entry:

When the equipment is purchased (assumed here to be the same day), this journal entry would be made:

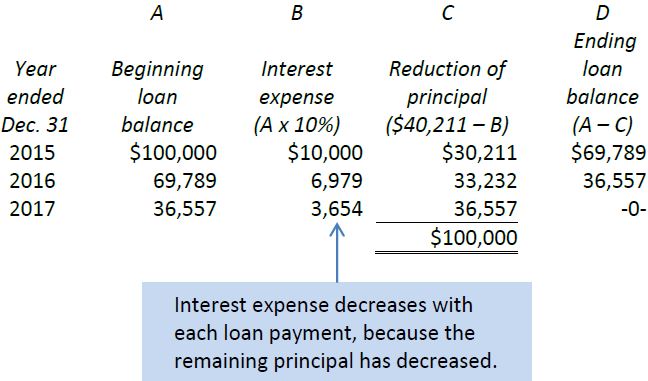

BDCC will depreciate this long-lived asset as usual over its estimated useful life, as discussed in a previous chapter. Interest is calculated on the unpaid balance of the loan. This balance decreases over the life of the loan because each payment contains part interest and part principal payments. In the example above, assume the $100,000 loan is repayable in three annual blended payment of $40,211. Each payment is made on December 31, commencing in 2015. While the payments remain the same each year, the amounts of interest paid decrease while the amount of principal repaid increases. Figure 9.2 illustrates this effect. Note particularly columns B, C, and D.

Figure 9.2 can be used to construct the journal entries to record the loan payments at the end of each year:

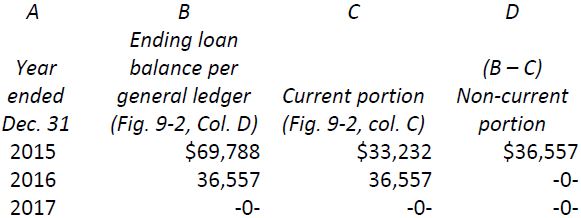

The amounts in Figure 9.2 can also be used to present the related information on the financial statements of BDCC at each year-end. Recall that assets and liabilities need to be classified as current and non-current on the balance sheet. Current liabilities are amounts paid within one year of the balance sheet date. Part of the loan payable to First Bank will be paid in the upcoming year. Therefore, it needs to be classified as a current liability on the balance sheet even though the full amount of the loan outstanding is reported in a single general ledger account called Loan Payable – First Bank. The amount of the total loan outstanding at December 31, 2015, 2016, and 2017 and the current and non-current portions are shown in Figure 9.3:

Balance sheet presentation would be as follows at each year-end:

| 2015 | 2016 | 2017 | ||

| Current liabilities | ||||

| Current portion of borrowings | $33,232 | $36,557 | $ -0- | |

| Non-current liabilities | ||||

| Borrowings (Note X) | 36,557 | -0- | -0- | |

Details of the loan would be disclosed in a note to the financial statements. Only the principal amount of the loan is reported on the balance sheet. The interest expense portion is reported on the income statement as an expense. Because these payments are made at BDCC’s year-end (December 31), no interest payable is accrued or reported on the balance sheet in this example.

- 3194 reads