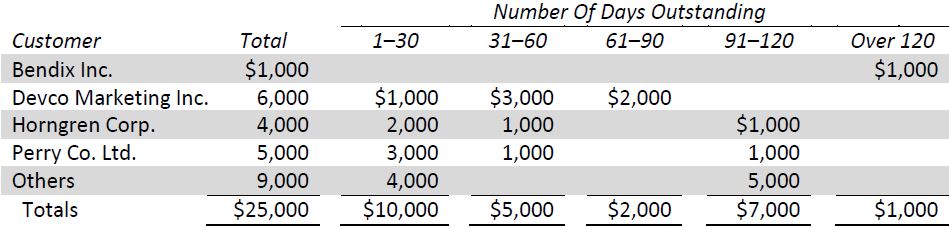

Estimated uncollectible accounts can also be calculated by using the balance sheet method where a process called aging of accounts receivable is used. At the end of the period, the total of estimated uncollectible accounts is calculated by analyzing accounts receivable according to how long each account has been outstanding. An aging analysis approach assumes that the longer a receivable is outstanding, the less chance there is of collecting it. This process is illustrated in the following schedule.

In this example, accounts receivable total $25,000 at the end of the period. These are classified into five time periods: those receivables that 1–30 days past due; 31–60 days past due; 61–90 days past due; 91–120 days past due; and over 120 days past due.

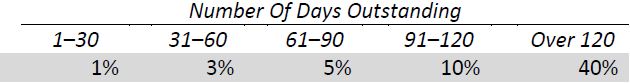

Based on past experience, assume management estimates a bad debt percentage for each time period as follows:

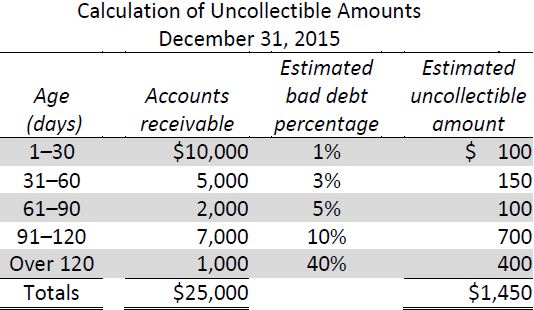

The calculation of expected uncollectible accounts receivable at December 31, 2015 would be as follows:

A total of $1,450 of accounts receivable is estimated to be uncollectible at December 31, 2015.

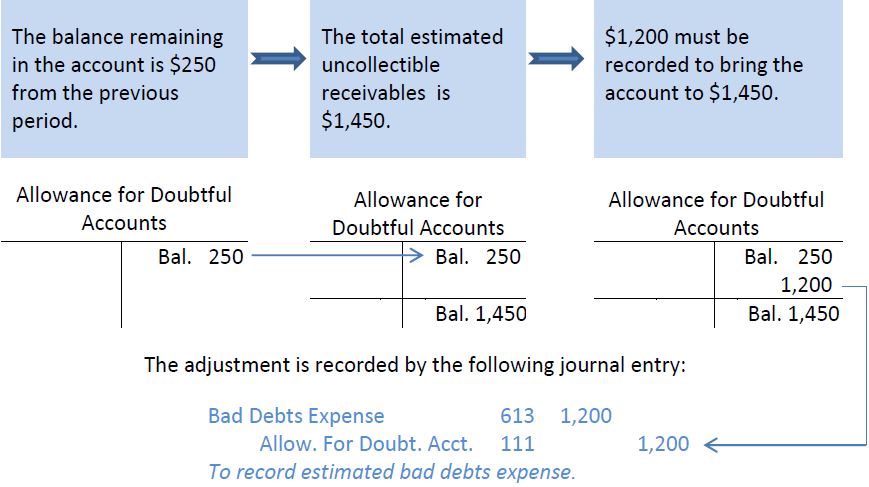

Under the balance sheet method, the estimated bad debt expense consists of the difference between the opening allowance for doubtful accounts balance ($250, as in the prior example) and the estimated uncollectible receivables ($1,450) required at year-end.

As an alternative to using an aging analysis to estimate uncollectible accounts, a simplified balance sheet method can be used. The simplified balance sheet method calculates the total estimated uncollectible accounts as a percentage of the outstanding accounts receivables balance. For example, assume an unadjusted balance in the allowance for doubtful accounts of $250 as in the preceding example. Also assume the accounts receivable balance at the end of the period was $25,000 as in the previous illustration. If it was estimated that 6% of these would be uncollectible based on historical data, the adjustment would be:

The total estimated uncollectible accounts was $1,500 ($25,000 × 6%). Given an unadjusted balance in allowance for doubtful accounts of $250, the adjustment to allowance for doubtful accounts must be a credit of $1,250 ($1,500 - $250).

Regardless of whether the income statement method or balance sheet method is used, the amount estimated as an allowance for doubtful accounts seldom agrees with the amounts that actually prove uncollectible. A credit balance remains in the allowance account if fewer bad debts occur during the year than are estimated. There is a debit balance in the allowance account if more bad debts occur during the year than are estimated. By monitoring the balance in the Allowance for Doubtful Accounts general ledger account at each yearend, though, management can determine whether the estimates of uncollectible amounts are accurate. If not, they can adjust these estimates going forward.

- 3767 reads