The steps used to prepare a statement of cash flows are as follows:

Step 1 Set up a cash flow table.

Step 2 Calculate the changes in each balance sheet account.

Step 3 Analyze changes in non-cash balance sheet accounts.

Step 4 Prepare the cash flow from operating activities section of the SCF.

Step 5 Prepare a statement of cash flows.

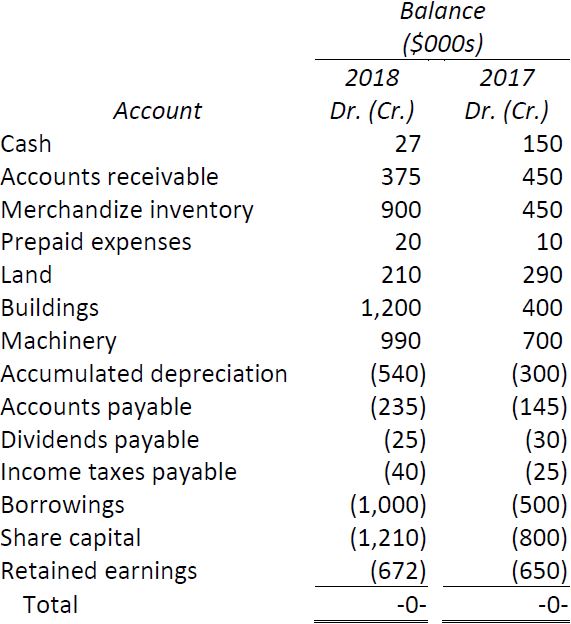

Step 1 Set up a cash flow table

Set up a table as shown below with a row for each account shown on the balance sheet. Enter amounts for each account for 2017 and 2018. Show credit balances in parentheses. Total both columns and ensure they equal zero. The table should appear as follows after this step has been completed:

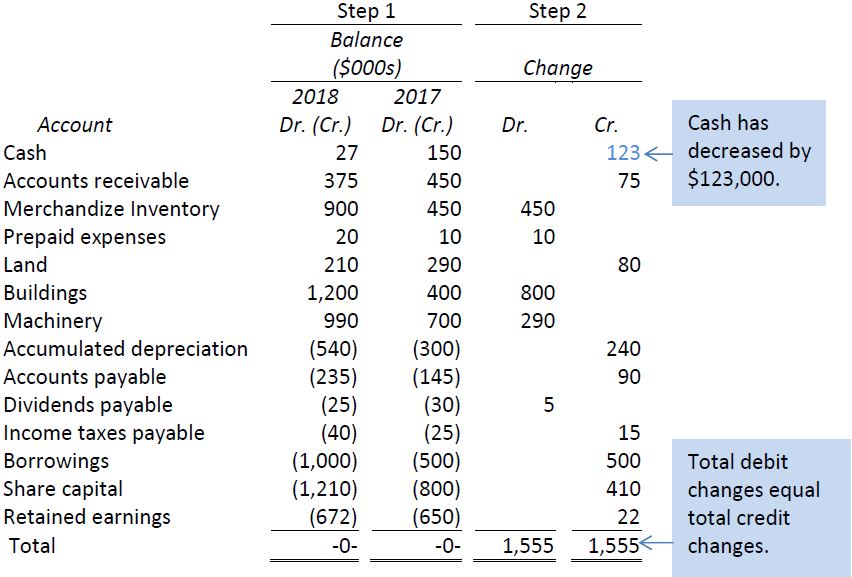

Step 2 Calculate the changes in each balance sheet account

Add two columns to the cash flow table. Calculate the net debit or net credit changes for every account on the balance sheet and insert these changes in the appropriate column. This step is shown below.

Step 3 Analyze changes in non–cash balance sheet accounts

Recall from earlier chapters that a cash inflow is recorded as a debit to cash. For instance, a cash sale of $100 is recorded as:

Similarly, a cash outflow is recorded as a credit to cash. Purchase of $50 of inventory for cash is recorded as:

This same principle is used to record cash inflows and outflows from operating, investing, and financing activities when the cash flow table method is used to prepare the SCF. A debit to cash represents a cash inflow; a credit to cash represents a cash outflow. Each type of activity represents a cash flow effect, in or out.

The next step is to set up three columns to the right of the “Change” columns shown in the table above. These columns should be titled “Cash Effect—Inflow,” “Cash Effect—Outflow,” and “Activity.” Record the changes in each account listed in Step 2 as a cash inflow effect if the account’s change is a credit (because the opposing debit represents an increase in cash, and therefore a cash inflow). It is a cash outflow effect if the change is a debit (because the opposing credit represents a decrease in cash, a cash outflow). The cash flow table should appear as follows:

The $123 net outflow in all non-cash balance sheet accounts ($1,432 – 1,555) equals the $123 decrease in cash ($150 – 27). An analysis of these non-cash accounts below the thick black line will explain the net outflow of cash. Each account shown in the table above will be examined to determine whether the observed changes result from operating, investing, or financing activities.

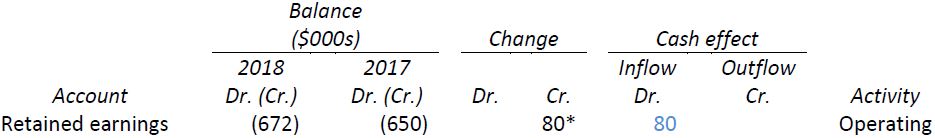

Procedure 1: Calculating cash flow from operating activities

Calculating cash flow from operating activities is the first step in preparing a statement of cash flows. Net income of $80,000 is used as the starting point. Let’s assume for the moment that this net income represents a net inflow of cash from operating activities of the same amount. The summary journal entry would be

Therefore, the first cash flow table effect we record is to the Retained Earnings account. The effect on the SCF would be a $80,000 cash inflow, shown as follows:

(*The actual change is a $22 credit. This $58 discrepancy will be explained in Procedure 3a)

The net income is recorded as an operating activity in the cash flow table. However, this amount includes three categories of items that must be adjusted to derive cash flow from operating activities: (a) net debit and credit changes in working capital that do not affect the income statement; (b) losses and gains not due to normal operations of the entity; and (c) expenses and revenues not involving cash. These are explained below.

a. Analysis of working capital accounts that do not affect the incomestatement

The first category of adjustments involves working capital accounts that are used in accrual accounting. For Example Corporation, these consist of:

|

Current assets |

Current liabilities |

|

Accounts receivable |

Accounts payable |

|

Merchandize inventory |

Income taxes payable |

|

Prepaid expenses |

The criteria for inclusion are whether adjustments through these accounts at some point affect items on the income statement. As a result, changes to the related Dividends Payable account are not considered operating activities. (Payment of dividends directly affects the Retained Earnings account, not a net income account.) The Dividends Payable account is therefore not analyzed at this point.

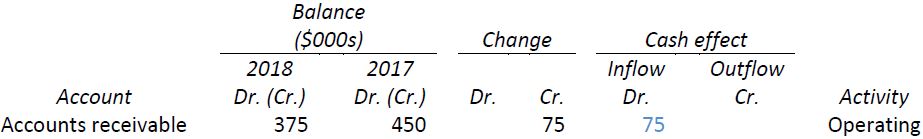

The remaining non-cash current asset and current liability accounts are relevant to the calculation of cash flow from operating activities because they affect expense and revenue items in the income statement. Examples of related items are sales on account that are recorded as accounts receivable, and merchandize purchases that eventually are reflected as cost of goods sold. The effects of changes in these accounts on net income must be considered when calculating cash flow from operating activities.

First, consider the change of $75 credit in the Accounts Receivable balance from the end of 2017 to 2018. If the relative levels of accounts receivable have decreased by $75 from 2017 to 2018 (a credit), a $75 cash inflow (a debit) has also occurred, as shown in the related cash effect column below.

In effect, Example Corporation has produced cash inflow during 2018 by speeding up cash collections of its accounts receivable from customers. This overall effect is not reflected in net income. This cash inflow must be added to the net income figure when calculating cash flow from operating activities in the statement of cash flows.

Next, consider the working capital account Merchandize Inventory. The balance in this account has increased by $450 from 2017 to 2018. If the relative levels of merchandize inventory have increased by $450 (a debit), cash of $450 has been used to accomplish this. This activity has not been included in net income. Hence the $450 credit (a cash outflow) shown in the cash effect column below needs to be deducted from the net income figure used as the starting point in determining cash flow from operating activities on the SCF. Similarly, the Prepaid Expenses balance has increased by $10 (a debit) from 2017 to 2018. To accomplish this, a $10 cash outflow (a credit) must have occurred, also as shown in the related cash effect column below. This amount also needs to be deducted from net income on the SCF to arrive at cash flow from operating activities.

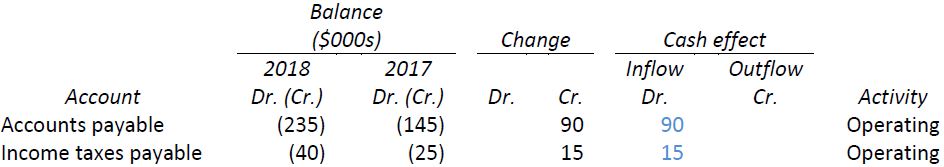

The next applicable working capital account to be analyzed is Accounts Payable, a liability. Refer to the table below. The balance in this account has increased by $90 from 2017 to 2018. In effect, Example Corporation has delayed cash payments to its short-term creditors during 2018, causing this liability account to increase. An increase in a liability is indicated by a credit. The consequent effect on cash is the opposite – a debit, denoting a cash inflow effect. Example Corporation has provided more cash for itself by delaying payments to trade creditors. Similarly, the Income Taxes Payable liability account has increased by $15 from 2017 to 2018 (a credit). The consequent cash effect is a $15 inflow (a debit), as shown in the table. By increasing the amount that Example Corporation owes to the government, the company has created a $15 cash inflow effect compared to the prior year. These effects are shown as cash inflows from operating activities on the SCF. They are added to net income to arrive at cash flow from operating activities.

b. Losses and gains not due to normal operating activities

Losses and gains on disposal of capital assets are not part of normal operations and therefore do not affect cash flow from operating activities. Since a loss is deducted when calculating net income, it is added back when calculating cash flow from operating activities on the SCF. Conversely, a gain on sale is included in net income reported on the income statement. It is deducted from the net income starting point when calculating cash flow from operating activities on the SCF.

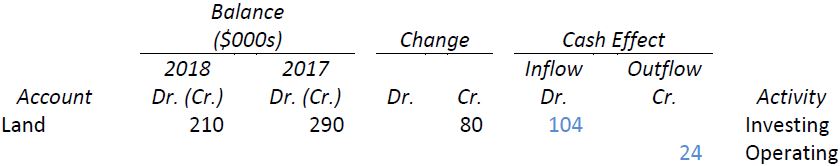

The first example of this effect arises when analyzing the changes to the Land account. As noted previously (Transaction 1), land originally costing $80 was sold for $104. The journal entry to record the sale of the land would have been:

The sale of the land thus has two effects on the SCF, as shown in the cash effects columns in the table below. First, the gain of $24 is shown as a credit. It was initially included in net income, but does not relate to day-to-day operations. Therefore, the gain is deducted from net income on the SCF to negate the original effect and arrive at cash flow from operating activities. This is done by recording it as a cash outflow. Second, in the above journal entry, the $104 sale proceeds are shown as a cash inflow (debit). This represents a cash inflow from an investingactivity, since it involves a non-current asset account. The cash effects are shown below.

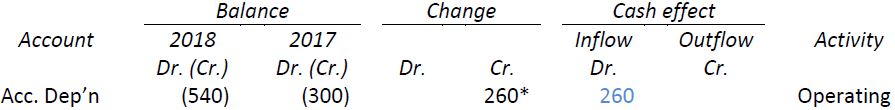

c. Expenses and revenue not involving cash

These consist of non-cash amounts that were included in the calculation of net income – depreciation expense in this case. Depreciation for 2018 amounted to $260 as shown on the Example Corporation income statement. The entry to record the amount must have been

Note that this entry does not involve cash flow. As a result, it is addedback to net income on the SCF to reverse its effect and arrive at cash flow from operating activities. Hence it is shown as a $260 debit in the cash effect column of the table, as shown below:

* The actual change is $240. This discrepancy will be explained in Procedure 2c.

In addition to adjustments described above needed to translate net income reported on the income statement into cash flow from operating activities, the remaining cash flow table accounts need to be analyzed to complete the SCF. This process is described below.

Procedure 2: Calculating Cash Flow from Investing Activities

To calculate cash flow from investing activities, non-current asset accounts are analyzed, as follows:

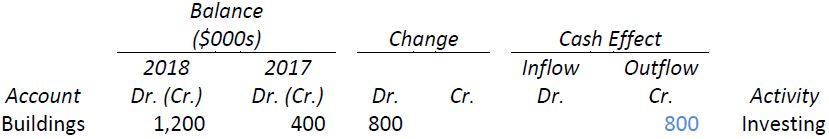

a. Analysis of Buildings account

As noted earlier, a building was purchased for $800,000 cash. The journal entry would have been:

The effect on cash is obvious – a cash outflow of $800,000 (a credit) is recorded in the applicable cash effect column in the table as shown below. Since this transaction affects a non-current asset account, it is recorded in the investing section of the SCF. (Depreciation on the building is assumed to be zero to simplify the illustration.)

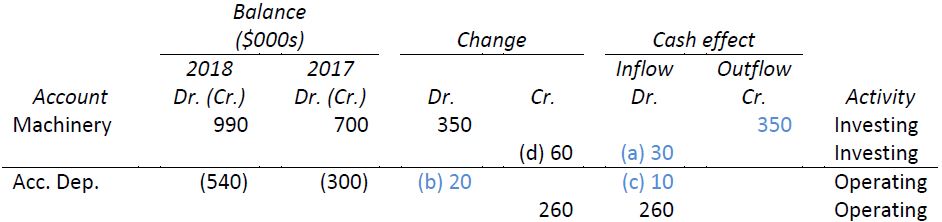

b. Analysis of Machinery account - purchases

The next accounts to be analyzed are the Machinery and Accumulated Depreciation accounts. Recall that machinery costing $350,000 was purchased for cash. The journal entry to record this would be:

The cash effect should be a $350,000 outflow (a credit). Since this transaction affects a non-current asset account, it is recorded in the Investing section of the SCF.

* The actual change is $290. This discrepancy will be explained in Procedure 2c.

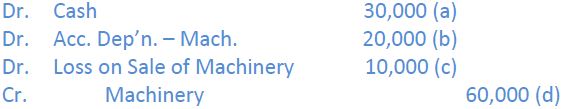

c. Analysis of Machinery account - disposals

The transactions recorded to this point do not fully account for the change in the Machinery account balances from 2017 to 2018 ($990 – 700 = $290 debit) nor the Accumulated Depreciation balances ($540 – 300 = $240 credit). An additional transaction needs to be considered. As noted earlier, machinery costing $60,000 and having accumulated depreciation of $20,000 was sold for $30,000 cash.

The journal entry to record the sale would be:

There are two types of cash effects that need to be recorded in the SCF. The $10 loss on sale (c) originally has been deducted to arrive at net income on the income statement. Since the transaction does not relate to an operating activity, it is recorded as a debit (cash inflow) in the applicable cash effect column and added back to net income on the SCF to arrive at cash flow from operating activities.

Second, the $30 cash proceeds (a) from the sale need to be recorded as a cash inflow (debit) in the cash effects column, and shown as an investing activity on the SCF. The cash flow table would show these effects as follows:

After these adjustments, all the changes in the Machinery and Accumulated Depreciation accounts have been recorded.

Procedure 3: Calculating cash flow from financing activities

The last accounts to be analyzed are the non-current liability and shareholders’ equity accounts. These comprise financing activities reported on the SCF.

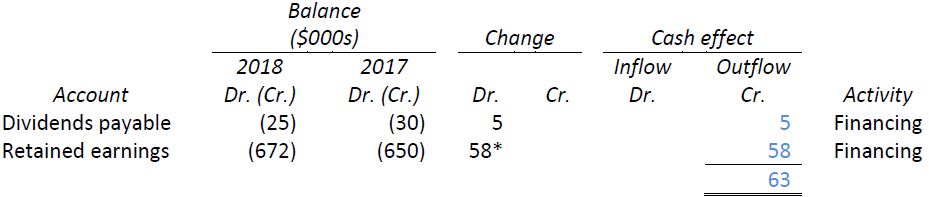

a. Analysis of dividends

Changes in the Dividends Payable account from 2017 to 2018 are analyzed in conjunction with any dividends declared during 2018. Transaction 8 above noted that these amounted to $58,000. This is also disclosed on the statement of changes in equity. As well, dividends payable have decreased by $5 from 2017 to 2018 ($25 – 30 = $5 debit). This means that an additional $5 credit (cash outflow) must have occurred that need to be recorded in the cash flow table and the SCF. Together, the effect on the SCF is recorded as a $63,000 cash outflow from financing activities ($58,000 + $5,000), as shown in the cash effects column below.

*The actual net change is a $22 credit. The balancing amount is the $80 net income credit, explained in Procedure 1 above.

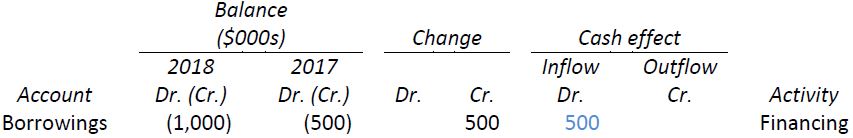

b. Analysis of borrowings

Transaction 6 shown above stated that Example Corporation received $500,000 cash from a long-term bank loan. This is reflected in the change in the Borrowings account from 2017 to 2018. The journal entry to record this transaction would have been:

As shown in the journal entry above, the cash effect is a $500,000 inflow (debit). This is shown in the applicable cash effects column below. This is recorded as a financing activity on the SCF because it relates to a noncurrent liability account.

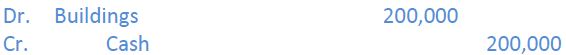

A note about offsetting cash flows

Certain transactions may involve offsetting cash inflows and outflows. For instance, if a $200,000 building is acquired entirely by borrowing money from a bank, the journal entry would be:

Based on this entry, there is no cash effect. However, for SCF purposes, two transactions are considered to have occurred. First, the receipt of the bank loan proceeds:

This would be shown as a cash inflow in the financing section of the SCF. Second, the purchase of the building:

This would be shown as a cash outflow in the investing section of the SCF. These effects are automatically considered using the cash flow table method, since each balance sheet account is considered separately.

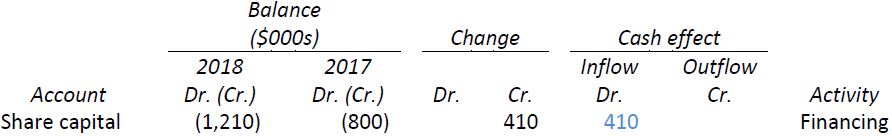

c. Analysis of share capital

As noted in transaction 7 above, share capital of $410,000 was issued during 2018. This accounts for the entire change in this account. The entry to record this transaction would have been:

The cash effect is a $410,000 inflow (debit), as shown by the journal entry and in the cash effects column below. This is recorded as a financing activity inflow on the SCF because it relates to a shareholders’ equity account.

All accounts have now been analyzed. Based on this, the revised cash flow table is as follows:

From this, the statement of cash flows can be prepared, classified into operating, investing, and financing activities.

Step 4 Prepare the cash flow from operating activities section ofthe SCF

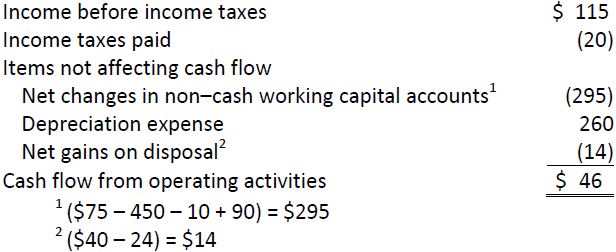

The following cash flow from operating activities section of the SCF can now be prepared from the information in the cash effects columns in the cash flow table (amounts in 000s). Each activity labelled “Operating” in the completed cash flow table is used:

To start the SCF preparation process, we originally assumed that net income of $80,000 was the same amount of cash inflow from operating activities. After adjusting net income for the three categories of items that do not affect cash flow, we see that cash flow from operating activities is actually only $46,000. The major effects accounting for this difference are the add-back of depreciation expense ($260,000) and the large cash expenditures to build up inventory during 2018 ($450,000).

There are still some slight changes needed to the cash flow from operating activities section of the SCF to conform to generally accepted accounting standards.

|

a. |

Income taxes paid need to be disclosed separately. To accomplish this, income before income taxes is used as the starting point instead of net income. The income taxes expense of $35 as shown on the income statement is considered a separate cash outflow. This is combined with the change in the income taxes payable account between 2017 and 2018. The change in the income taxes payable account is a $15 credit ($40 – 25). The cash effect of this change is a $15 debit, or a cash inflow. The net effect on the SCF is that income taxes have created a $20 cash outflow during the year ($35 outflow – $15 inflow). |

|

b. |

For presentation brevity, often the changes in non-cash working capital accounts are combined and shown as one amount. Gains and losses on disposal are also combined into one amount. If desired, details of these changes can be disclosed in a note to the financial statements. |

The revised cash flow from operating activities section of the SCF would show:

Note that cash flow from operating activities ($46) has not changed.

Step 5 Prepare a statement of cash flows

When analysis is complete, the cash effects columns of the cash flow table contain all the information needed to prepare the statement of cash flows:

- 3819 reads