Montana Inc. had the following transactions relating to uncollectible accounts during 2016:

|

Jan. |

22 |

Wrote off J. Asanti’s account of $400 as uncollectible |

|||

|

Mar. |

6 |

Collected from Z. Byrd $200 that had been written off in 2015 |

|||

|

July |

4 |

Received $600 from M. Peron (Peron’s previous balance was $1,400); no further payments are expected and the balance was written off |

|||

|

Sept. |

7 |

Wrote off R. Ngeun’s account for $700 |

|||

|

Dec. |

31 |

Analysed accounts receivable, revealing the following: |

|||

|

a. |

Accounts to be written off: |

||||

|

R. Bouchard |

$600 |

||||

|

S. O’Malley |

800 |

||||

|

C. Macintosh |

200 |

||||

|

b. |

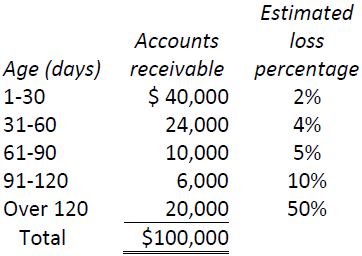

Ageing of accounts receivable: |

||||

Required:

- Assume that there was a credit balance of $3,000 in the Allowance for Doubtful Accounts general ledger account at December 31, 2015. Prepare the entry to write off the uncollectible accounts at December 31, 2016.

- Prepare the appropriate adjusting entry to set up the required balance in the Allowance for Doubtful Accounts general ledger account at December 31, 2016.

- 1832 reads