| LO4 – Estimate merchandize inventory using the gross profit method and the retail inventory method. |

A physical inventory count determines the quantity of items on hand. When costs are assigned to these items and these individual costs are added, a total inventory amount is calculated. Is this dollar amount correct? Should it be larger? How can one tell if the physical count is accurate? Being able to estimate this amount provides a check on the reasonableness of the physical count and valuation.

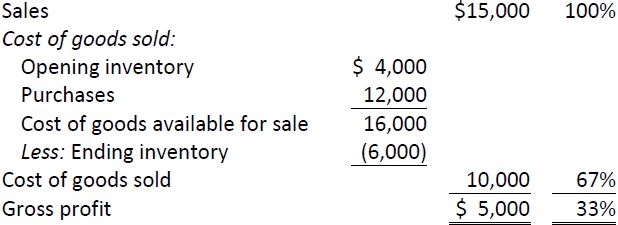

The two methods used to estimate the inventory dollar amount are the gross profit method and the retail inventory method. Both methods are based on a calculation of the gross profit percentage in the income statement. Assume the following information:

The gross profit percentage, rounded to the nearest whole percent, is 33% ($5,000/15,000). This means that for each dollar of sales, an average of $.33 is left to cover other expenses after deducting cost of goods sold.

Estimating ending inventory requires an understanding of the relationship of ending inventory with cost of goods sold.

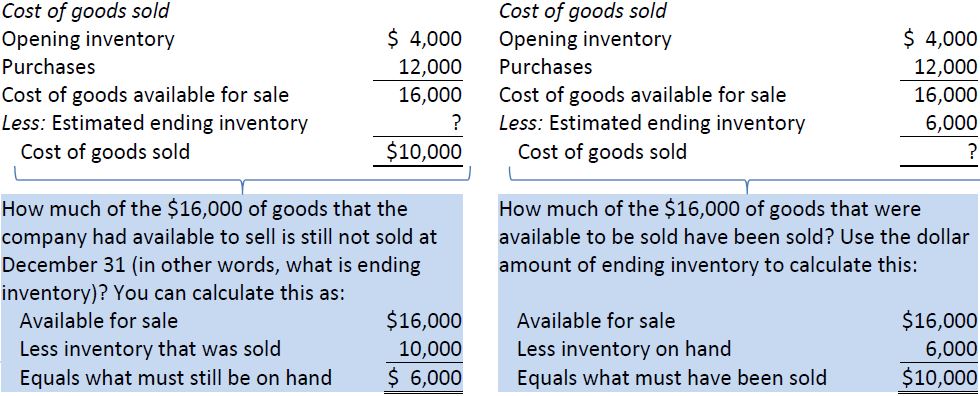

Review the following cost of goods sold calculations.

The sum of cost of goods sold and ending inventory is always equal to cost of goods available for sale. Knowing any two of these amounts enables the third amount to be calculated. Understanding this relationship is the key to estimating inventory using either the gross profit or retail inventory methods, discussed below.

- 4063 reads