Short-term bank loans, accounts payable and unearned revenues were introduced in previous chapters. Payroll liabilities are amounts owing to various agencies on behalf of employees. These include items withheld from employees’ pay cheques. Common withholdings are personal income taxes, employment insurance, pension and health insurance contributions, and union dues. These withheld amounts are remitted by the employer to agencies like the government, a private pension plan administrator, a union, or a health care provider, and usually within a few days of being deducted. Gross pay is the amount of salaries or wages 1 to which employees are entitled before any deductions. Net pay is the actual cash payment that the employees receive at the end of a pay period after deductions are made.

In most countries, the employer is required by law to also contribute to certain government programs designed to aid workers. In Canada, for example, the employer generally must contribute 1.4 times as much to an employment insurance program as employees contribute, and contribute the same amount to a government pension plan that employees are required to contribute. The employer may also contribute to a private pension plan or private health insurance plan under the terms of a collective agreement, for instance.

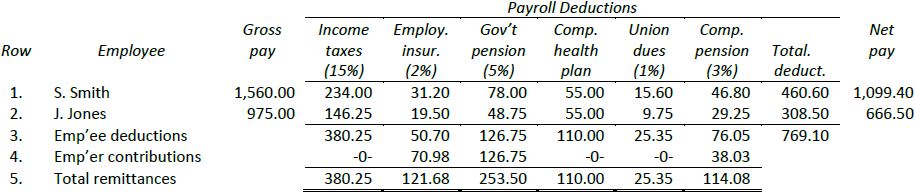

Assume a company has two employees. Each employee is required to have the following amounts deducted from their gross pay each period:

|

Personal income taxes |

15% |

|

Employment insurance |

2% |

|

Government pension |

5% |

|

Union dues |

1% |

|

Company pension plan |

3% |

In addition, each employee contributes $55 per pay period to a company health plan.

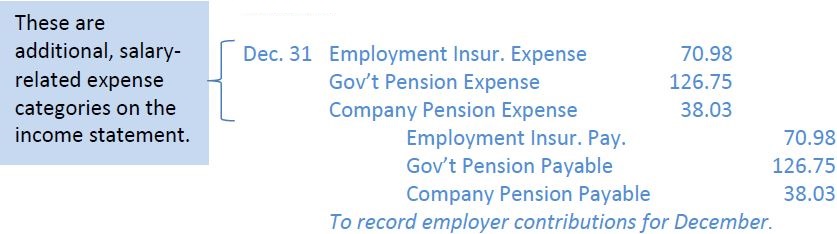

To demonstrate the journal entries to record a business’s payroll liabilities for the period December 1-15, 2015, refer to the payroll records in Figure 9.1 (Emp’ee = employee; Emp’er = employer). Assume that in addition to amounts that it withholds from employees’ pay as shown in row 3, the company also must contribute 1.4 times as much as its employees to an employment insurance plan, must match government pension contributions, and must contribute one-half as much to the company pension plan as its employees. The company therefore incurs additional expenses as shown in row 4. These are calculated as follows:

|

Employment insurance ($50.70 x 1.4) |

$70.98 |

|

Government pension plan ($113.66 x 1.0) |

$113.66 |

|

Company pension plan ($76.05 x ½) |

$38.03 |

Usually, companies do not have to contribute anything towards personal income taxes and union dues paid by their employees. Additionally in this example, the company does not contribute to the company health plan.

The journal entry to record the cheque paid to S. Smith would be:

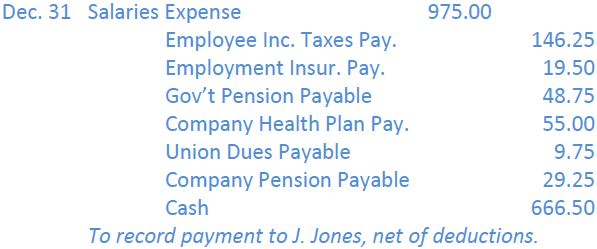

The journal entry to record the cheque paid to J. Jones would be:

The journal entry to record the company’s matching contributions would be:

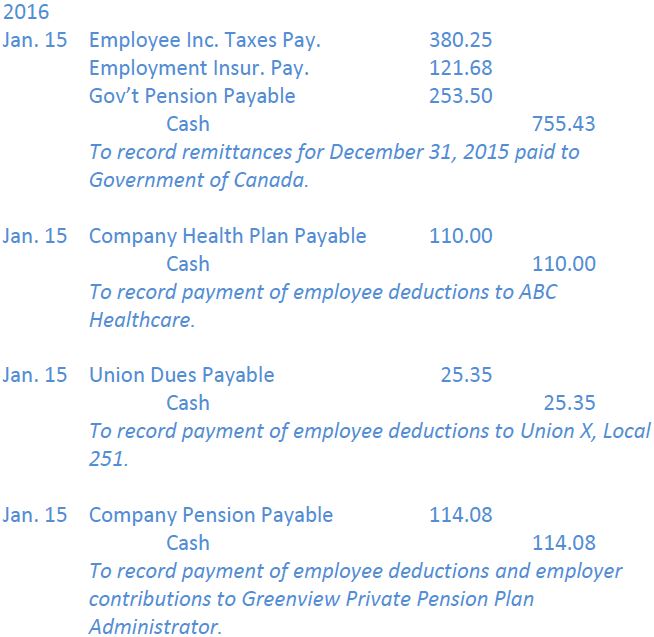

The deductions payable accounts would be recorded as current liabilities on the December 31, 2016 balance sheet since they will be remitted to various agencies within the next few weeks. When these payments are made, say on January 15, 2016, the following four entries would be made to eliminate these current liability accounts:

- 2084 reads