| LO5 – Explain and prepare a classified multiple-step income statement for a merchandizer. |

Businesses are required to show expenses on the income statement based on either the nature or the function of the expense. The natureof an expense is determined by its basic characteristics (what it is). For example, when expenses are listed on the income statement as interest, depreciation, income taxes, or salaries, this identifies the nature of each expense. In contrast, the function of an expensedescribes the grouping of expenses based on their purpose (what they relate to). For example, an income statement that shows cost of goods sold, selling expenses, and general and administrative expenses has grouped expenses by their function. When expenses are grouped by function, additional information must be disclosed to show the nature of expenses within each group. Full disclosure is the generally accepted accounting principle that requires financial statements to report all relevant information about the operations and financial position of the entity. Information that is relevant but not included in the body of the statements is provided in the notes to the financial statements.

A merchandizing income statement can be prepared in different formats. For this course, only one format will be used—the classified multiple-step format. This format is generally used only for internal reporting because of the detail. Most external financial statement users would find this detail excessive and distracting.

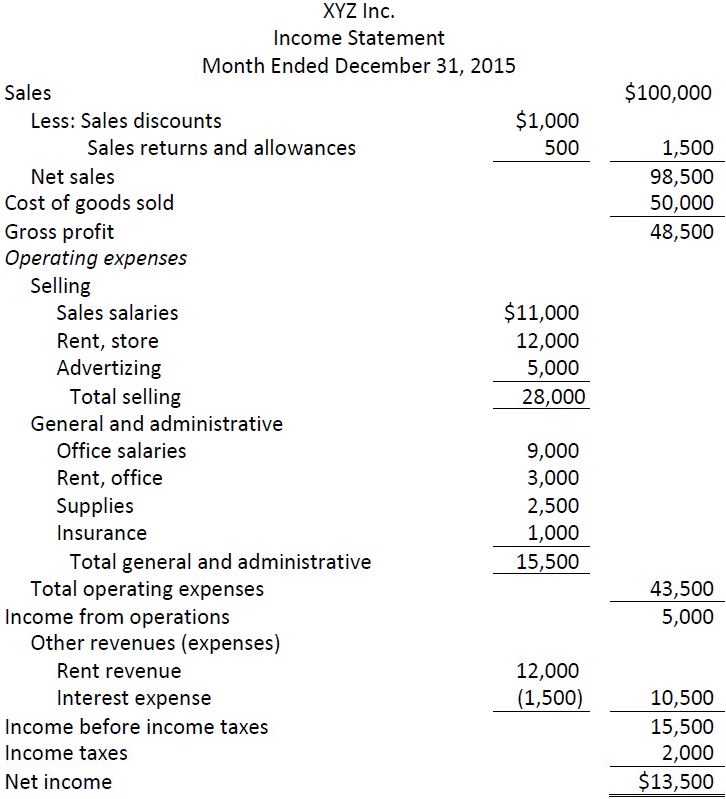

An example of a classified multiple-step income statement is shown below using assumed data for XYZ Inc. for its month ended December 31, 2015.

Notice that the classified multiple-step income statement shows expenses by both function and nature. The broad categories that show expenses by function include operating expenses, selling expenses, general and administrative expenses, and income taxes. Within each category, the nature of expenses is disclosed including sales salaries, advertizing, depreciation, supplies, and insurance. Notice that Rent Expense and Depreciation Expense have been divided between two groupings because these apply to more than one category or function.

The normal operating activity for XYZ Inc. is merchandizing. Revenues and expenses that are not part of normal operating activities are listed under Other Revenues and Expenses. XYZ Inc. shows Rent Revenue under Other Revenues and Expenses because this type of revenue is not part of its merchandizing operations. Interest earned, dividends earned, and gains on the sale of property, plant, and equipment are more examples of other revenues not related to merchandizing operations. XYZ Inc. deducts interest expense under Other Revenues and Expenses. Interest expense does not result from operating activities; it is a financing activity because it is associated with the borrowing of money. Other examples of non-operating expenses include losses on the sale of property, plant, and equipment. Finally, income taxes expense is deducted. Income tax is a government levy, unrelated to how a business operates.

- 7293 reads