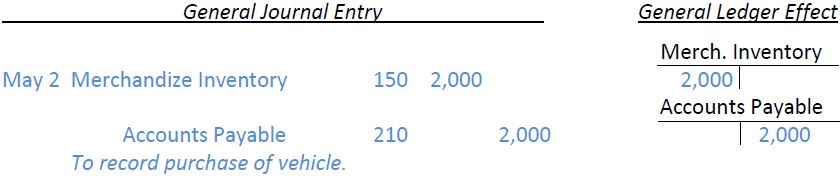

When merchandize inventory is purchased, the cost is recorded in a Merchandize Inventory general ledger account. An account payable results when the merchandize inventory is acquired but will not be paid in cash until a later date. For example, recall the vehicle purchased on account by Excel Cars Corporation for $2,000. Assume this was purchased on May 2, 2016. The journal entry and general ledger T-account effects would be as follows:

In addition to the purchase of merchandize inventory, there are other activities that affect the Merchandize Inventory account. For instance, merchandize may occasionally be returned to a supplier or damaged in transit, or discounts may be earned for prompt cash payment. These transactions result in the reduction of amounts due to the supplier and thus the costs of inventory. The purchase of merchandize inventory may also involve the payment of transportation and handling costs. These are all costs necessary to prepare inventory for sale, and all such costs are included in the Merchandize Inventory account. These costs are discussed in the following sections.

- 2222 reads