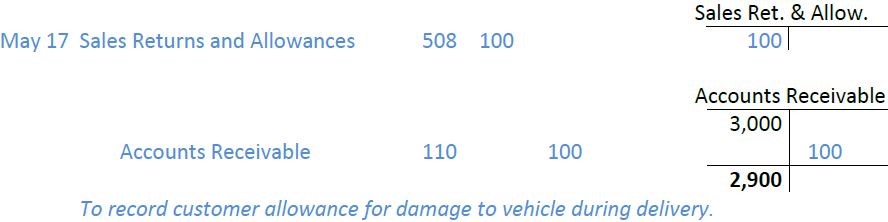

When merchandize inventory that has been sold is returned to the merchandizer by the customer, a sales return and allowance is recorded. For example, assume some damage occurs to the car sold by Excel while it is being delivered to the customer on May 17. Excel would give the customer a sales allowance by agreeing to reduce the amount owing by, say, $100. The entry is:

Accounts receivable is credited because the original sale was made on account and has not yet been paid. The amount owing from the customer is reduced to $2,900. If the $2,900 had already been paid, a credit would be made to Cash and $100 refunded to the customer. The Sales Returns and Allowances account is a contra revenue account, meaning it is deducted from Sales when preparing the income statement.

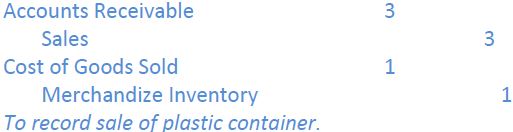

If goods are returned by a customer, a sales return occurs. The related sales and cost of goods sold recorded on the income statement are reversed and the goods are returned to inventory. For example, assume Max Corporation sells a plastic container for $3 that it purchased for $1. The dual entry at the time of sale would be:

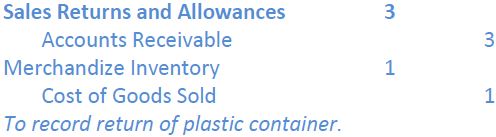

If the container is returned, the journal entry would reverse the original entry, except that Sales Returns and Allowances would be debited instead of the Sales account:

Use of a Sales Returns and Allowances contra account allows management to track the amount of returned and damaged items for their information purposes.

- 6207 reads