A corporation may find its shares are selling at a high price on a stock exchange, perhaps putting them beyond the reach of many investors. To increase the marketability of a corporation’s shares, management may opt for a share split. A share split increases the number of shares issued and outstanding, and lowers the cost of each new share. The originally-issued shares are exchanged for a larger number of new shares

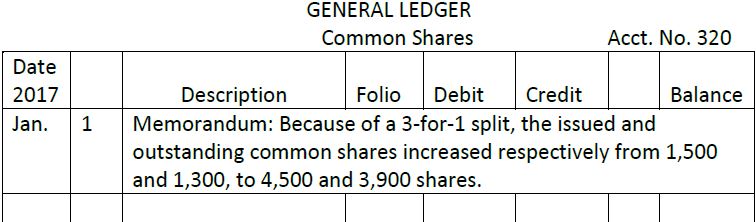

Assume that on December 1, 2017 New World Corporation declares a 3-for-1 common share split. This results in three new common shares replacing each currently-issued and outstanding common share. The number of issued and outstanding shares has now been tripled. The market price of each share will decrease to about one-third of its former market price. Since there is no change in the dollar amount of common shares, no debit-credit entry is required to record the share split. Instead, a memorandum entry would be recorded in the general ledger indicating the new number of shares issued and outstanding, as follows:

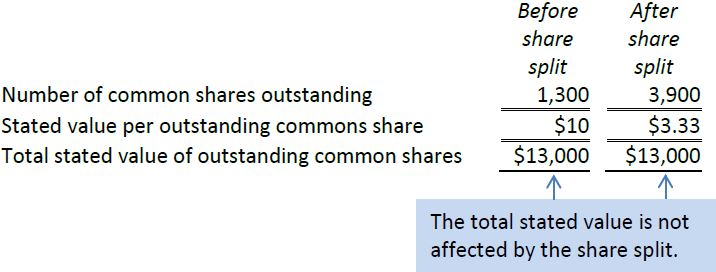

The dollar amount shown on the balance sheet and statement of changes in equity will not change. The only change is an increase in the number of issued and outstanding common shares. After the share split, the shareholders’ equity section of the New World Corporation balance sheet and statement of changes in equity would be unchanged.

This would be added to the usual note to the financial statements:

The company holds 600 issued common shares as treasury shares. On December 1, 2017 the company declared a 3:1 share split on common shares. The effect of this was as follows:

- 1923 reads