| LO2 – Explain the use of and prepare the adjusting entries required for prepaid expenses, depreciation, unearned revenues, accrued revenues, and accrued expenses. |

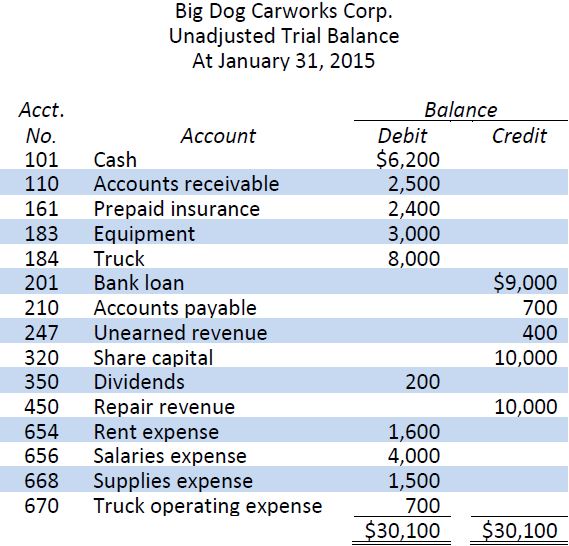

At the end of an accounting period, before financial statements can be prepared, the accounts must be reviewed for potential adjustments. This review is done by using the unadjusted trial balance. The trial balance of Big Dog Carworks Corp. at January 31 was prepared in Chapter 2 and is reproduced in Figure 3.4 below. It is an unadjusted trial balance because the accounts have not yet been updated for accruals and other adjustments. We will use this trial balance to illustrate how adjustments are identified and recorded.

Adjustments are recorded with adjusting entries. Their purpose is to ensure both the balance sheet and the income statement more accurately represent financial information. Adjusting entries help satisfy the matching principle.

There are five types of adjusting entries, each of which will be discussed in the following sections.

- Adjust prepaid assets;

- Adjust unearned liabilities;

- Adjust plant and equipment assets;

- Adjust accrued revenues; and

- Adjust accrued expenses

An accrued revenue is a revenue that has been earned but has not yet been collected or recorded. An accrued expense is an expense that has been incurred but has not yet been paid or recorded.

- 4475 reads