| LO3 – Explain the purpose and content of notes to financial statements. |

As an integral part of its financial statements, a company provides notes to the financial statements. In accordance with the disclosure principle, these provide relevant details that are not included in the body of the financial statements. For instance, details about Big Dog’s property, plant, and equipment are shown in Note 4 in the following sample notes to the financial statements. The notes help external users better understand and analyze the financial statements.

Although a detailed discussion of disclosures that might be included as part of the notes is beyond the scope of an introductory financial accounting course, a simplified example of note disclosure is shown below for Big Dog Carworks Corp.

|

Big Dog Carworks Corp. Notes to the Financial Statements For the Year Ended December 31, 2018 |

|||||||

|

1. |

Nature of operations The principal activity of Big Dog Carworks Corp. is the servicing and repair of vehicles. |

||||||

|

2. |

General information and statement of compliance with IFRS Big Dog Carworks Corp. is a limited liability company incorporated and domiciled in Canada. Its registered office and principal place of business is 123 Fox Street, Edmonton, Alberta, T5J 2Y7, Canada. Big Dog Carworks Corp.’s shares are listed on the Toronto Stock Exchange. The financial statements of Big Dog Carworks Corp. have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued the International Accounting Standards Boards (IASB). The financial statements for the year ended December 31, 2018 were approved and authorized for issue by the board of directors on March 17, 2019. |

||||||

|

3. |

Summary of accounting policies The financial statements have been prepared using the significant accounting policies and measurement bases summarized below. |

||||||

|

a. |

Revenue Revenue arises from the rendering of service. It is measured by reference to the fair value of consideration received or receivable. |

||||||

|

b. |

Operating expenses Operating expenses are recognized in the income statement upon utilization of the service or at the date of their origin. |

||||||

|

c. |

Borrowing costs Borrowing costs directly attributable to the acquisition, construction, or production of property, plant, and equipment are capitalized during the period of time that is necessary to complete and prepare the asset for its intended use or sale. Other borrowing costs are expensed in the period in which they are incurred and reported as interest expense. |

||||||

|

d. |

Property, plant, and equipment Land held for use in production or administration is stated at cost. Other property, plant, and equipment are initially recognized at acquisition cost plus any costs directly attributable to bringing the assets to the locations and conditions necessary to be employed in operations. They are subsequently measured using the cost model: cost less subsequent depreciation. Depreciation is recognized on a straight-line basis to write down the cost, net of estimated residual value. The following useful lives are applied: |

||||||

|

Buildings: 25 years Equipment: 10 years Truck: 5 years |

|||||||

|

Residual value estimates and estimates of useful life are updated at least annually. |

|||||||

|

e. |

Income taxes Current income tax liabilities comprise those obligations to fiscal authorities relating to the current or prior reporting periods that are unpaid at the reporting date. Calculation of current taxes is based on tax rates and tax laws that have been enacted or substantively enacted by the end of the reporting period. |

||||||

|

f. |

Share capital Share capital represents the nominal value of shares that have been issued. |

||||||

|

g. |

Estimation uncertainty When preparing the financial statements, management undertakes a number of judgments, estimates, and assumptions about the recognition and measurement of assets, liabilities, income, and expenses. Information about estimates and assumptions that have the most significant effect on recognition and measurement of assets, liabilities, income, and expenses is provided below. Actual results may be substantially different. |

||||||

|

4. |

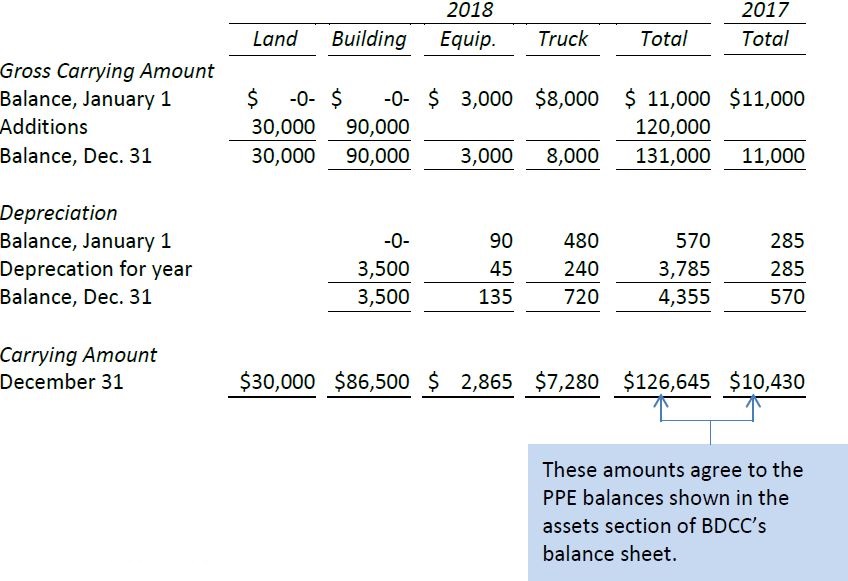

Property, plant, and equipment

Details of the company’s property, plant, and equipment and their carrying amounts at December 31 are as follows: |

||||||

|

5. |

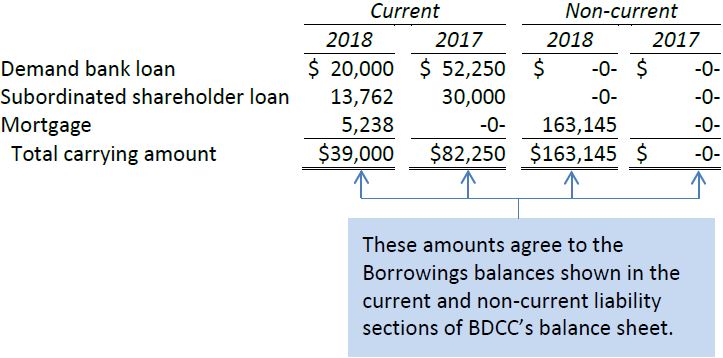

Borrowings

Borrowings include the following financial liabilities measured at cost: The bank loan is due on demand and bears interest at 6% per year. It is secured by accounts receivable and inventories of the company. The shareholder loan is due on demand, non-interest bearing, and unsecured. The mortgage is payable to First Bank of Alberta. It bears interest at 5% per year and is amortized over 25 years. Monthly payments including interest are $960. It is secured by land and buildings owned by the company. The terms of the mortgage will be renegotiated in 2021. |

||||||

|

6. |

Share capital The share capital of Big Dog Carworks Corp. consists of fully-paid common shares with a stated value of $1 each. All shares are eligible to receive dividends, have their capital repaid, and represent one vote at the annual shareholders’ meeting. There were no shares issued during 2017 or 2018. |

||||||

- 瀏覽次數:2381